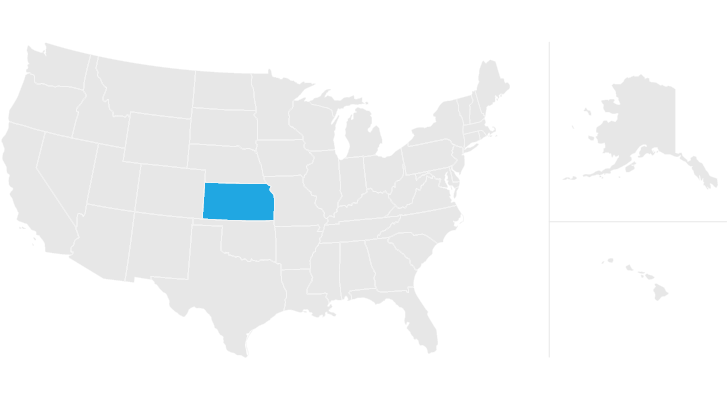

does kansas have inheritance tax

08 percent to 16 percent on estates above 1 million. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013.

There is no federal inheritance tax but there is a federal estate tax.

. If you die without a will in Kansas your assets will go to your closest relatives under state intestate succession laws. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

Estate tax of 8 percent to 12 percent on estates above 58 million. You may also need to file some taxes on behalf of the deceased. State inheritance tax rates range from 1 up to 16.

The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. In 2021 federal estate tax generally applies to assets over 117 million. The estate tax is not to be confused with the inheritance tax which is a different tax.

Kansas has no inheritance tax either. Beneficiaries are responsible for paying the inheritance tax on what they inherit. Another states inheritance laws may apply however if you inherit money or assets.

Kansas does not collect an estate tax or an inheritance tax. Here are some details about. Kansas does have an inheritance tax but it is paid by the estate not the recipient.

We have already discussed the fact that Kansas does not have an estate tax gift tax or. Maryland is the only state in the country to impose both. Kansas does not collect an estate tax or an inheritance tax.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or. Kansas law requires a petition to be filed to open a probate case within six months of an individuals death according to the Kansas Bar Association.

Inheritance tax of up to 10 percent. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Massachusetts and oregon have the lowest exemption levels at 1 million and connecticut has the highest exemption level at 71.

If you live in a state without an inheritance tax you will not owe anything on the property simply because you inherited it. Kansas Inheritance and Gift Tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. However another states inheritance tax rules could apply if you inherit money from someone who passes away in another state. Inheritance tax of up to 15 percent.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The inheritance tax applies to money or assets after they are already passed on to a persons heirs. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Estate tax of 08 percent to 16 percent on estates above 5 million. Kansas does not assess an inheritance tax either. Here are some tax rates and exemptions that you should be aware of.

However if you are inheriting property from another state that state may have an estate tax that applies. States including kansas do not have estate or inheritance taxes in place as of 2013. That is a recent tax law change 2010.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. How Does Inheritance Work. However if you are inheriting property from another state that state may have an estate tax that applies.

You may also need to file some taxes on behalf of the deceased. Inheritance tax of up to 16 percent. Another states inheritance laws.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Surviving spouses are always exempt. If you live in kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

Kansas does not have an estate or inheritance tax. The top estate tax rate is 16 percent exemption threshold. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

The assets that remain at the end of the process are distributed to the beneficiaries the decedent named in a will or to certain family members.

Kansas Inheritance Laws What You Should Know

Kansas Inheritance Laws What You Should Know

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Free Excel Macros Vba Masterclass In 2021 Excel Macros Microsoft Excel Tutorial Excel Tutorials

2022 Corporate Tax Rates In Europe Tax Foundation

Paul Gaulkin Cpa Is An Intelligent Consulting Person He Is Knowledgeable Person In Tax Consulting Paul Has Helped Tax Debt Credit Card Debt Relief Irs Taxes

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas Estate Tax Everything You Need To Know Smartasset

Does Kansas Charge An Inheritance Tax

State Death Tax Is A Killer The Heritage Foundation

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Kansas Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)